Weekly Market Commentary – 1/27/2023

-Darren Leavitt, CFA

Momentum trade pushed US equity markets higher and forced shorts to cover and those sitting in cash to move off the sidelines for fear of missing out on further gains. Fourth quarter earnings continued to come in with a mixed bag of results. According to Factset, 29% of the S&P 500 has reported 4th quarter earnings. Last week MMM, Microsoft, Texas Instruments, Boeing, Intel, and Chevron announced worst-than-expected results. On the other hand, defense companies Raytheon and Lockheed Martin had better than expected results, along with consumer discretionary giant Tesla. In the energy complex, Chevron announced a record $75 billion share buyback and increased its dividend but disappointed investors with its earnings results.

The S&P 500 gained 2.5% and extended ground relative to its 200-day moving average. The Dow added 1.8%, the NASDAQ jumped 4.3%, and the Russell 2000 increased by 2.4%. US Treasury yields were higher across the curve but noticeably higher in the belly of the curve. The 2-year yield increased by one basis point to 4.21%, while the 10-year yield increased by four basis points to 3.52%. Oil prices fell 2.7%, with WTI closing at $79.45 a barrel. Gold prices were little changed, closing at $1929.60 an Oz. Copper prices fell by $0.04 to $4.22 an Lb.

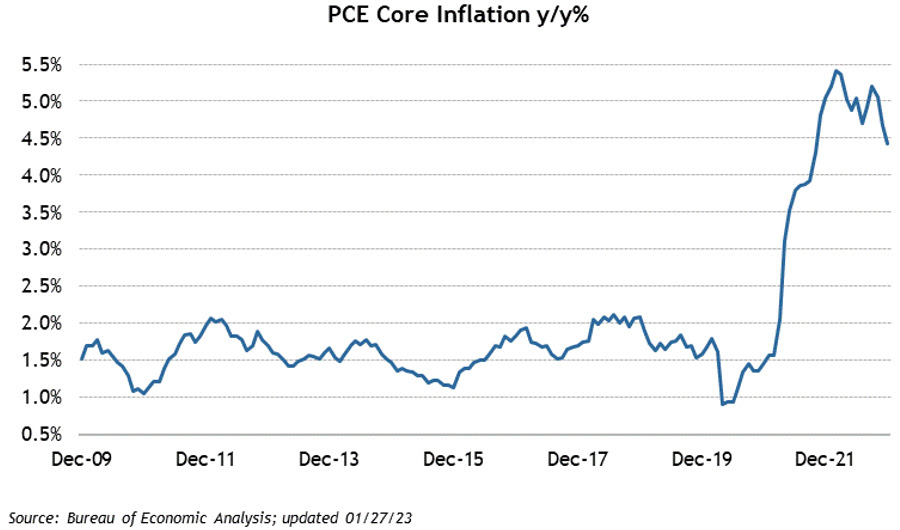

Economic data for the week showed a resilient economy with prices moderating. Initial jobless claims came in at 186k below the expected 200k while Continuing Claims increased to 1675k from 1655k. The first look at the 4th quarter GDP indicated a better-than-expected 2.9% growth rate; the street had been looking for 2.8%. The GDP chain deflator, which accounts for all economic prices, ticked a bit higher to 3.5% from the prior reading of 3.3%. Personal spending declined by 0.2%, while Personal Income increased by 0.2%. PCE (Personal Consumption Expenditures Price Index) increased by 0.1%, slightly higher than the 0% expectation. Core PCE, which excludes food and energy, was in line with estimates of 0.3%. On a year-over-year basis, PCE rose by 5% versus the prior month’s increase of 5.5%. Core PCE rose by 4.4% year-over-year relative to the preceding month’s 4.7% increase.

This coming week investors will get another tranche of 4th quarter earnings highlighted by Google, Meta, and Apple. The FOMC meeting with conclude on Wednesday, where it is widely expected that the Fed will raise its policy rate by 25 basis points. Markets will also be very interested in the January Employment Situation report due on Friday morning for clues on how the labor market is holding up.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.